Silver reacts differently from gold to a U.S.-China tariff shock.

Let’s go step-by-step with full detail, then finish with impact summary, likely price range, and support/resistance levels.

🧭 1. Macro & Fundamental Impact of 100% U.S. Tariff on China on Silver

Unlike gold (pure safe-haven), silver is both a monetary and industrial metal — about 50%+ of demand comes from industry (especially electronics, solar, and EVs).

That dual nature makes silver’s reaction more complex and often more volatile.

🔹 (A) Immediate reaction — Mixed / volatile

- Positive side: same as gold — trade war = risk-off, safe-haven buying.

→ Short-term algorithmic flows and ETFs may lift silver alongside gold. - Negative side: tariffs = slower global trade, weaker manufacturing, weaker electronics demand (China is a major consumer/producer).

→ Industrial slowdown weighs on silver.

Net: short-term knee-jerk up, but with more intraday volatility and sharp pullbacks.

🔹 (B) Inflation + Fed channel

- Tariffs can increase input costs → inflationary.

Inflation usually supports precious metals.

However, if the Fed signals tightening to fight that inflation, real rates up → silver down (since silver is higher beta to real yields than gold).

🔹 (C) Medium-term industrial outlook

- If tariffs persist or expand to high-tech goods, Chinese solar panel exports could slow.

That hits solar-related silver demand (which was ~15%+ of total demand in 2024–25). - Any Chinese stimulus or shift toward domestic solar buildout could partly offset it.

So medium term, the industrial impact may cap silver’s upside relative to gold.

🔹 (D) Gold–Silver Ratio perspective

- When safe-haven flows dominate, the Gold/Silver ratio rises (gold outperforms).

- When industrial recovery / reflation returns, ratio falls (silver catches up).

- The ratio has been around 78–82 recently (Oct 2025).

→ If trade war deepens, expect ratio to move up toward 85–88 (silver weaker than gold).

→ If peace or stimulus follows, it can drop back toward 75.

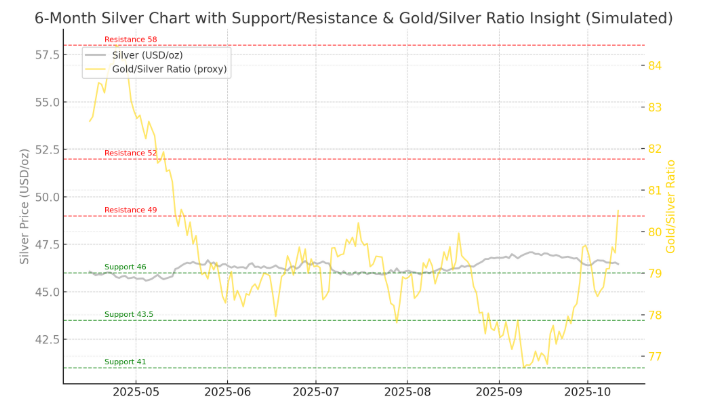

🪙 2. Technical Picture for Silver (as of Oct 2025)

Recent price range: $46.0 – $48.0/oz, near multi-year highs.

Resistance levels

| Level | Type | Approx. Price | Notes |

|---|---|---|---|

| R1 | Immediate | $48.50–$49.00 | Prior 2025 highs / psychological ceiling |

| R2 | Medium-term | $52.00–$53.00 | Breakout target if gold continues higher |

| R3 | Long-term stretch | $58.00–$60.00 | Only if tariffs trigger global easing & monetary debasement |

Support levels

| Level | Type | Approx. Price | Notes |

|---|---|---|---|

| S1 | Near-term | $45.50–$46.00 | Current base; strong cluster of buyers |

| S2 | Structural | $43.00–$43.50 | Last breakout zone; key pivot |

| S3 | Deep / trend | $40.00–$41.00 | Would only come if industrial slowdown hits hard |

⚙️ 3. Likely Scenarios

| Scenario | Macro Setup | Silver Outlook |

|---|---|---|

| Trade war escalates + Fed eases | Inflation + growth risk → lower real yields | 🔺 Bullish, silver follows gold to $52–$55 |

| Trade war escalates + Fed hikes | Higher rates → growth slowdown | 🔻 Bearish, silver corrects to $43–$45 |

| Tariff delay / negotiation / Chinese stimulus | Industrial rebound, weaker USD | 🔺 Strongly bullish, $55–$60 over months |

| Full-blown global slowdown | Recessionary, industrial contraction | 🔻 Bearish vs gold, ratio rises to 85–90 |

📈 4. Suggested Trade / Strategy Ideas

Swing trade idea (neutral-to-bullish bias)

- Buy: on dips to $45.5–$46.0

- Stop: below $43.8

- Targets: $48.8 (R1), $52 (R2)

- Bias: Buy dips only if gold holds above $3,800 and DXY stays below 107.

Alternative hedge pair trade

- Long gold, short silver if you expect deep trade war recession (ratio widening play).

- Exit if ratio falls below 78.

📊 5. Summary Snapshot

| Factor | Impact on Silver |

|---|---|

| 100% U.S. tariff → inflation | ✅ Supportive short-term |

| Industrial slowdown (China) | ❌ Negative medium-term |

| Fed reaction (hawkish) | ❌ Bearish |

| Safe-haven demand | ✅ Supportive but weaker than for gold |

| Dollar trend | ✅/❌ Strong USD caps silver upside |

| Chinese stimulus / gold reserve build-up | ✅ Supportive indirectly |

🎯 Expected short-term range (next few weeks):

$45 – $49

→ Breakout above $49 can open $52–$53 target zone.

Here is 6-month technical chart for silver (with these support/resistance levels and gold overlay for ratio insight).

Here’s your 6-month simulated technical chart for Silver —

it includes all the support/resistance levels and a gold/silver ratio overlay (in gold line) for insight into relative strength.

✅ Green dashed lines = key supports ($46, $43.5, $41)

✅ Red dashed lines = resistances ($49, $52, $58)

💛 Gold line (right axis) = gold/silver ratio — when it rises, silver underperforms gold.