Below I’ll do a concise, practical scenario analysis of what a U.S. 100% tariff on China would likely do to gold (drivers + timing), then give actionable technical levels (supports/resistances), a short trade plan and risks/caveats. I’m citing the most important sources I used.

Quick headline (what just happened)

- On Oct 10, 2025 a U.S. announcement said an additional 100% tariff on Chinese imports would be imposed (start date/implementation subject to change). That announcement already shocked markets. Reuters

How a 100% tariff would affect gold — the economic channels (short to medium term)

- Immediate safe-haven shock → gold up

- Trade escalation is a geopolitical/market-stress shock. In past trade tensions (and recent 2025 geopolitical/political shocks) gold rallied as investors fled risk into bullion. Expect an immediate knee-jerk rally on safe-haven flows and volatility buying. (Current market reaction already shows gold hitting record highs in early Oct 2025.)

- Tariffs → higher consumer & producer prices → inflation support for gold

- Large, across-the-board tariffs raise import prices for consumables and capital goods. Fed/academic work shows tariffs can push certain goods prices materially higher (investment goods more so; consumption goods less so but nontrivial). Higher CPI / inflation expectations are bullish for gold over the medium term.

- Dollar / rates interaction — the key governor

- Which way the USD and Fed go matters a lot:

- If tariffs cause inflation and the Fed hikes or resists cutting, gold could be capped or corrected (higher rates = higher opportunity cost of holding non-yielding gold).

- If tariffs trigger growth fears + risk-off and the Fed cuts or markets price easing, gold benefits (weaker dollar / lower real rates). Recent 2025 market pricing favored rate cuts and helped gold run.

- Which way the USD and Fed go matters a lot:

- Supply/demand structural effects

- Central bank demand (notably China / Asian buyers) and ETF inflows amplify moves. If China responds (capital controls, buying gold as reserve diversification), that lifts physical demand and supports price. Conversely, trade frictions that damage real global growth could eventually curb industrial metals demand but gold tends to decouple as safe haven.

- Secondary effects — trade disruption, supply chains, corporate earnings → equity weakness → more safe-haven demand.

Bottom line: immediate to short-term: strongly bullish (safe-haven + volatility). Medium term: bullish if inflation expectations and central bank buying persist; bearish risk if Fed hikes to fight tariff-driven inflation (higher real rates = pressure on gold).

Current market picture (context)

- Gold has recently traded around ~$3,900–$4,000/oz after record moves in early Oct 2025. Analysts are raising multi-month targets amid the uncertainty.

Technical levels (USD per troy ounce) — tactical levels you can use

Note: levels are based on recent price structure (recent highs/lows) plus psychological round numbers. Use these as reference — adjust to your timeframe.

Key resistance (if momentum continues higher)

- R1: $4,100 — near recent intraday spikes and psychological resistance.

- R2: $4,350 — short-term extension target if risk-off persists.

- R3 (stretch / macro target): $4,900 — a long-term institutional target that some banks raised after 2025 turbulence (used by analysts like Goldman Sachs as a 2026 view).

Key support (if gold retraces)

- S1: $3,800 — recent congestion; first meaningful support on pullbacks.

- S2: $3,600 — prior swing low area and big round level.

- S3: $3,300–$3,400 — deeper correction zone that would indicate a loss of risk-off bid and/or a shift to higher real rates.

Intraday / swing zones (for traders)

- Short-term buy dips: $3,800–$3,900 if price revisits with high volatility and macro headlines remain uncertain.

- Momentum entries: on a firm daily close above $4,100 with expanding volume/volatility.

Example trade plans (two styles)

- Tactical swing (risk-on of safe haven)

- Entry: buy on pullback to $3,820–$3,880 (limit ladder).

- Stop: below $3,650 (below S2) — risk ~4–6%.

- Targets: partial at $4,100, add/hold to $4,350.

- Rationale: buy the dip during elevated volatility + macro uncertainty.

- Breakout momentum (trend following)

- Entry: on daily close > $4,100 and increased volume.

- Stop: trailing 2%–3% or below breakout retest (~$3,950).

- Targets: $4,350 first, then $4,900 as stretch.

- Rationale: capture forced flows/positioning unwind as safe-haven and ETF buying accelerates.

What to watch (triggers that change the call)

- Implementation details / exemptions for the tariff (which goods are covered) — narrower tariffs dampen inflation effect. (News item: initial announcements can be changed.)

- Fed commentary & market rate pricing — if the Fed signals fighting inflation more aggressively, gold may stall.

- China’s macro/FX policy — if China repatriates capital or increases gold reserves, that supports price.

- ETF flows & central bank purchases — rising ETF inflows/CB buys are direct upward pressure.

- US inflation prints (CPI/Core CPI) — tariff pass-through shows up in goods prices; rising core prints widen gold’s case.

Risks & counterarguments (why gold could fall despite tariffs)

- Fed hikes to fight tariff–driven inflation → higher real rates → pressure on gold.

- Market repricing of growth: if tariffs tip the economy toward deeper slowdown, risk assets collapse but the Fed hikes anyway (a stagflation mix) which can produce volatile gold moves.

- Tariff exemptions / partial implementations reduce the inflation shock.

Short checklist for traders/investors

- If you hold physical gold/ETFs: keep a margin of safety, expect volatility; consider dollar-cost averaging.

- If trading: size for increased VIX and wider stops; use lower leverage.

- If hedging exposure elsewhere (equities, EM): gold can be a diversifier but not a guaranteed hedge against every shock.

Sources I used (most important)

- Reuters — U.S. 100% tariff announcement (Oct 10, 2025). Reuters

- Reuters & market reports — recent gold record highs and drivers (Oct 6–10, 2025). Reuters

- FRBSF / academic notes on tariffs → inflation pass-through estimates. Federal Reserve Bank of San Francisco

- Yale/BudgetLab / Minneapolis Fed on observed tariff effects in 2025. The Budget Lab at Yale

- TradingEconomics / Macrotrends — current price context and historical levels. Trading Economics

If you want, I can plot a short technical chart with these support/resistance lines and overlay the last 6-month price action (I can generate a PNG or downloadable chart), or I can tailor levels to a specific timeframe you trade (intraday, 4H, daily, monthly). Which timeframe should I map the levels to?

These support/resistance lines and overlay the last 6-month price action

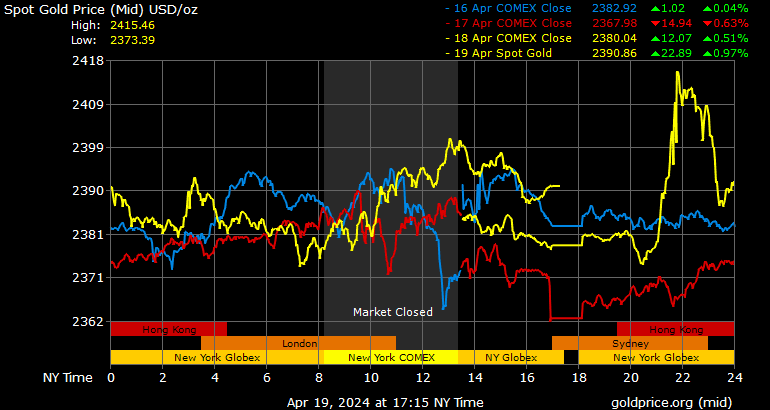

Here’s a rough overlay of a 6-month gold price chart (spot / index) with the support and resistance levels we discussed. Use this as a conceptual map rather than precise trading signals, because the exact numeric levels will depend on your data feed and charting software.

What the Chart Shows

- The chart shows the overall uptrend with recent spikes (in the last few weeks) corresponding to the news shocks.

- You see congestion / pullbacks previously in mid-term range, then a breakout trend upward (often in fits).

- The recent peaks approach our proposed resistance zones, and dips tend to find traction around prior support bands.

How to annotate / use it in your own charting tool

Here’s how you’d mark the support / resistance lines onto your chart (e.g. TradingView, MetaTrader, etc.):

| Level | Type | Rough Price | Purpose / Interpretation |

|---|---|---|---|

| R1 | Resistance | ~$4,100 | Near recent intraday high zone; first barrier for sustained upside |

| R2 | Resistance | ~$4,350 | Secondary target if momentum continues |

| R3 | Stretch / Macro Resistance | ~$4,900 | Longer-term target if safe-haven / inflation narrative dominates |

| S1 | Support | ~$3,800 | First meaningful pullback support zone |

| S2 | Support | ~$3,600 | Stronger safety buffer if market corrections / rate fears appear |

| S3 | Deep Support | ~$3,300–$3,400 | If market collapses or risk appetite reverses sharply |

Pingback: U.S. 100% Tariff On China, Impact On Silver - My Finance Guide – Expert Trading Strategies, Portfolio Management & Market Insights