Let’s now cover Volatility Indicators — these measure the rate and magnitude of price movement (how much the market fluctuates), helping traders detect breakout opportunities, risk levels, and when a trend might pause or reverse.

⚡ Volatility Indicators (Types + Use Cases)

1. Bollinger Bands (BB)

- Type: Volatility Bands

- How it works:

- Based on a 20-period SMA with upper/lower bands set at ±2 standard deviations.

- Bands expand = higher volatility, Bands contract = lower volatility (squeeze).

- Use Case:

- Detect breakouts after a squeeze.

- Identify overbought (near upper band) and oversold (near lower band) conditions.

2. Average True Range (ATR)

- Type: Volatility Measure

- How it works:

- Calculates the average range between high and low over a set period (usually 14).

- Higher ATR = more volatility.

- Use Case:

- Set stop-loss levels (e.g., 2 × ATR).

- Filter markets: avoid low ATR ranges if you want strong moves.

3. Keltner Channels

- Type: Volatility Bands

- How it works:

- Channels are based on EMA + ATR.

- Narrow channels = low volatility, Wide channels = high volatility.

- Use Case:

- Spot trend continuation or breakout when price closes outside the channel.

4. Donchian Channels

- Type: High/Low Channel

- How it works:

- Upper band = highest high of last N periods.

- Lower band = lowest low of last N periods.

- Use Case:

- Breakout strategy (buy on breakout above, sell on breakdown below).

- Widely used in Turtle Trading Strategy.

5. Chaikin Volatility Indicator

- Type: Volatility Oscillator

- How it works:

- Measures the difference between high and low prices over time, adjusted by EMA.

- Rising values = increasing volatility, Falling = decreasing volatility.

- Use Case:

- Anticipate price breakouts or consolidations.

6. Historical Volatility (HV)

- Type: Statistical Measure

- How it works:

- Uses standard deviation of returns over a specific time frame.

- Use Case:

- Often used in options trading to price risk.

- Compare with Implied Volatility (IV) to find cheap/expensive options.

✅ Summary Table

| Indicator | Type | Best Use |

|---|---|---|

| Bollinger Bands | Volatility Bands | Detect breakouts, overbought/oversold |

| ATR | Volatility Measure | Position sizing, stop-loss placement |

| Keltner Channels | EMA + ATR Bands | Trend continuation & breakout confirmation |

| Donchian Channels | High/Low Bands | Classic breakout trading |

| Chaikin Volatility | Oscillator | Volatility expansion/contraction alerts |

| Historical Volatility | Statistical | Options pricing, risk assessment |

⚡ Pro Tip:

Volatility indicators are best used with trend or momentum indicators. Example:

- Bollinger Band Squeeze + MACD breakout → high probability move.

- ATR-based stop-loss + ADX filter → safer trades.

Perfect 👌 Let’s build Best Volatility Indicator Combinations with ready-to-use trading rules (entry/exit conditions). These setups combine volatility tools with trend/momentum filters so signals are stronger and safer.

🔥 Best Volatility Indicator Combinations

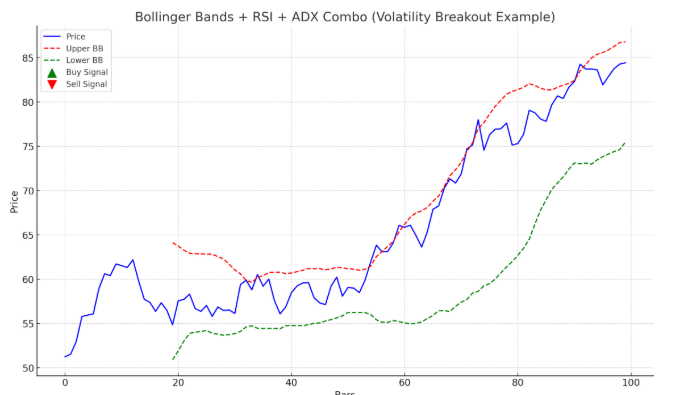

1. Bollinger Bands + RSI + ADX

✅ For Breakouts with Momentum Confirmation

Trading Rules:

- Buy Entry:

- Price closes above upper Bollinger Band.

- RSI > 60 (momentum confirmation).

- ADX > 20 (trend strength filter).

- Sell Entry:

- Price closes below lower Bollinger Band.

- RSI < 40.

- ADX > 20.

- Exit:

- RSI crosses back to neutral (45–55).

- Or opposite band touched.

📌 Works best for strong breakout trades after low volatility squeeze.

2. ATR + Supertrend + MACD

✅ For Trend Trading with Dynamic Stops

Trading Rules:

- Buy Entry:

- Supertrend turns bullish (green).

- MACD line crosses above signal line.

- ATR > average ATR (volatility expansion).

- Sell Entry:

- Supertrend turns bearish (red).

- MACD line crosses below signal line.

- ATR > average ATR.

- Exit / Stop-loss:

- Use 2 × ATR trailing stop.

📌 This is a strong swing-trading setup: ATR ensures you only trade when price is moving enough.

3. Donchian Channels + ADX + CCI

✅ For Turtle-Style Breakout Trading

Trading Rules:

- Buy Entry:

- Price closes above Donchian Channel high (20 periods).

- ADX > 25 (trend strength filter).

- CCI > +100 (bullish momentum).

- Sell Entry:

- Price closes below Donchian Channel low.

- ADX > 25.

- CCI < -100.

- Exit:

- Trail stop using Donchian midline or opposite signal.

📌 Best for medium-term breakout traders (similar to famous Turtle Trading).

4. Keltner Channels + Ichimoku Cloud + RSI

✅ For Trend Continuation & Pullback Trading

Trading Rules:

- Buy Entry:

- Price closes above Keltner upper channel.

- Ichimoku Cloud bullish (price above cloud).

- RSI between 50–70 (healthy uptrend, not overbought).

- Sell Entry:

- Price closes below Keltner lower channel.

- Ichimoku Cloud bearish (price below cloud).

- RSI between 30–50.

- Exit:

- When RSI hits extreme (≥ 80 or ≤ 20).

- Or price closes back inside Keltner channel.

📌 Good for swing traders who ride trend continuation moves.

✅ Quick Comparison Table

| Combo | Best For | Strength |

|---|---|---|

| BB + RSI + ADX | Breakouts | Catches strong momentum moves |

| ATR + Supertrend + MACD | Swing trades | Great for trend + volatility stop-loss |

| Donchian + ADX + CCI | Turtle breakout | Proven strategy for medium-term moves |

| Keltner + Ichimoku + RSI | Trend continuation | Filters fake breakouts with Ichimoku |

⚡ Pro Tip:

- Use BB or Keltner for breakout signals.

- Use ATR for stop-loss & position sizing.

- Use ADX/RSI/CCI to confirm trend strength & momentum.

👉 A visual chart walkthrough showing one of these volatility combos in action with entry/exit markers?

Here’s a visual chart walkthrough of the Bollinger Bands + RSI + ADX volatility breakout setup:

- Blue line → Price

- Red dashed line → Upper Bollinger Band

- Green dashed line → Lower Bollinger Band

- Green ▲ markers → Buy signals (price breaks upper band, RSI > 60, ADX > 20)

- Red ▼ markers → Sell signals (price breaks lower band, RSI < 40, ADX > 20)

This shows how the volatility breakout + momentum filter can highlight strong entry/exit zones.