I want to begin with a strong caveat

There is no rigorous way to predict the daily direction of a major index like Nifty 50 with certainty. The market is driven by many stochastic, macro, micro, behavioral, and exogenous factors. What follows is a probabilistic “outlook + scenario analysis,” not a guarantee.

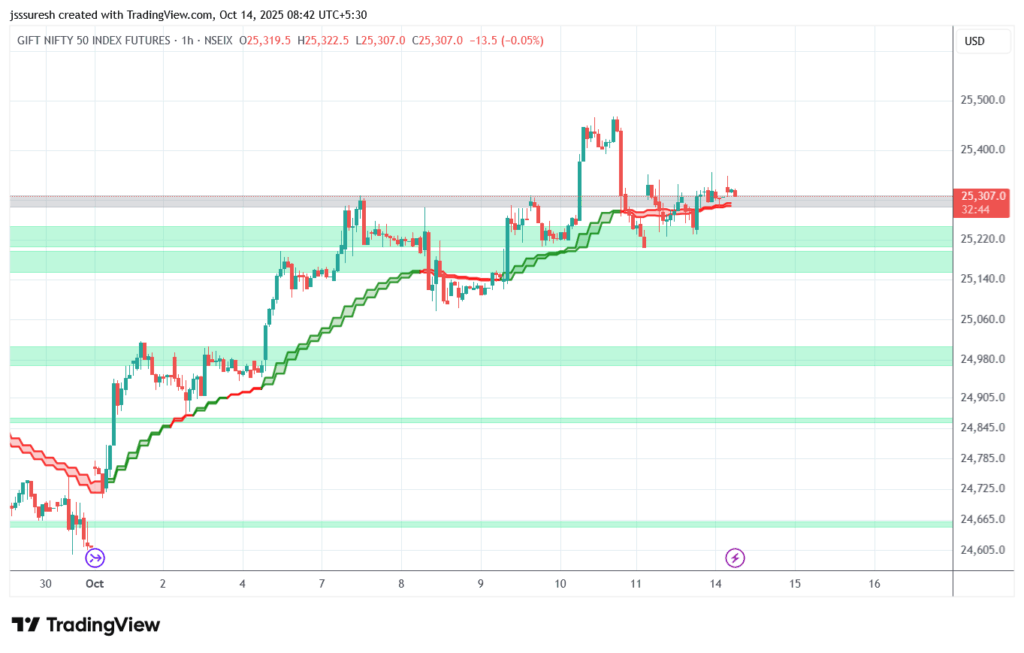

Current technical / indicator state

- Nifty has been consolidating in the 25,100–25,250 range, showing resilience in a mixed macro environment.

- Momentum indicators (RSI, MACD) remain mildly positive, though shorter-term oscillators appear stretched.

- Resistance likely around 25,300–25,450, support in 25,000–25,150.

- Trend remains cautiously bullish unless broken decisively lower.

Macro / fundamental / flow factors (with latest numbers)

- FPIs are net sellers in October with ~₹3,188 crore net outflow (Purchases ~₹29,277 crore vs Sales ~₹32,465 crore).

- CPI inflation is ~1.7 % YoY, comfortably under the RBI’s target band — supportive for dovish bias.

- RBI repo rate held at 5.50 %; FY26 projections: inflation ~2.6 %, GDP growth ~6.8 %.

- The rupee is steady near ₹88.78 / USD, with mild pressure from global dollar strength.

- Open Interest (OI) in Nifty options remains elevated (~2.97 crore contracts), indicating active positioning.

- Put OI is slightly higher than Call OI — suggests some hedging, with key support near 25,000.

GIFT Nifty – latest data & summary

- GIFT Nifty last traded at ₹25,323.00, up +17 (+0.07 %), as of 09:26 PM IST on Groww.

- Open: ₹25,310.50 | Prev Close: ₹25,306.00

- Snapshot summary: The mild positive move in GIFT Nifty indicates a neutral-to-slightly-bullish offshore sentiment, giving some positive bias to the Indian market open.

Scenario / directional probabilities & key levels

| Scenario | Trigger / Condition | Expected Move | Key Levels |

|---|---|---|---|

| Bullish continuation | Break & hold above 25,300–25,350 with volume & OI support | Upside toward 25,500–25,650 | Resistance: 25,500–25,650 |

| Range / consolidation | Trades within 25,050–25,300 | Sideways / oscillation | Support: 25,050 / Resistance: 25,300 |

| Pullback / correction | Rejection at resistance or adverse flows | Decline toward 25,000 → 24,850 | Support: 25,000 / 24,850 |

Estimated probabilities:

- Bullish continuation: 40 %

- Range / consolidation: 40 %

- Pullback / correction: 20 %

Risks & caveats

- Overbought short-term indicators may prompt sharp intraday reversals.

- Sudden macro or global shocks (rate surprises, trade wars) could override setups.

- Narrow breadth: gains are concentrated in fewer stocks, increasing risk of reversal.

- Watch for divergence between price action and OI/volume — that often flags traps.

Latest News & Global Cues

- IPO / Capital Market Growth: India is set for a surge in IPOs, with ~$5 billion expected in listings this month, signaling strong investor appetite. (FT)

- Domestic / Regulatory: NSE reports it faced 400 million cyberattack attempts in one day under “Operation Sindoor,” though trading was unaffected. (Times of India)

- Market Outlook: Analysts suggest that the Indian market is in a consolidation phase, building a base before a possible breakout, with structural growth areas like green energy, defense, and online retail in focus. (Economic Times)

- Corporate / GIFT City: Tata Asset Management has launched a new “Tata India Dynamic Equity Fund” in GIFT IFSC, aiming to attract global investors to Indian equities. (Economic Times)

- Trade / Global Risk: Resurgent U.S.–China tariff tension and global volatility remain headwinds for emerging markets like India.

My Daily Prediction (Probabilistic Bias) – Wednesday, October 15, 2025

Moderate upside bias with caution

Expect Nifty to open around 25,200–25,250. If it climbs above 25,300–25,350 with volume & OI confirmation, it could aim for 25,500+. If resistance holds, a retreat toward 25,000–24,900 is possible.

Bias: Slightly bullish, conditional on confirmation and global cues.

Market Mood Summary

The tone today is neutral-to-slightly risk-on — global cues are mixed but GIFT Nifty suggests modest optimism. Domestic flows and confirmation will decide whether the bias holds.