Here’s a focused, technical (chart-style) analysis of NIFTY 50 in the context of the U.S. threat of a 100% tariff on China (market news and data sourced below). I combine on-chain price facts, short-term indicators, key levels (S/R + Fibonacci), volume/volatility observations, and tactical trading scenarios tied to the tariff shock.

1) Snapshot & sources

- Latest indicative close used: 25,285.35 (Nifty close Oct 10, 2025).

- Tariff news & market reaction context (U.S. announcement → global risk-off / tech selloff).

I used the last 7 daily closes (Oct 1–10) and recent volumes from public index data to compute short-term technicals.

2) Short-term technical picture (computed from recent closes)

- Short-term momentum: modest positive close (25,285) but short-term drift is slightly negative on average — daily mean change ≈ –0.30% and daily volatility (std) ≈ 0.31% (based on last 6 daily changes). (calculation from public daily data).

- Short moving averages (simple):

- SMA-5 ≈ 25,139.9

- SMA-7 ≈ 25,061.4

Nifty is trading slightly above SMA-5 which suggests short-term marginal strength but the SMA cluster is close to price — a small move can flip bias. (computed from recent closes).

- Volume: average daily volume (last 5 trading days) ≈ 261 million shares (indicative). Recent sessions show elevated volumes on big U.S. news days — sign of participation in moves.

3) Key support & resistance (actionable levels)

Using the recent swing low → swing high (low 24,836.30 → high 25,329.60) gives useful intraday S/R:

- Immediate resistance: 25,329 — 25,400 (recent high zone).

- Near resistance cluster / pivot: 25,140 — 25,160 (SMA-5 ~ 25,139 & 38.2% Fib ≈ 25,141). (watch for close above this to confirm short continuation). (computed).

- Important near support 1: 25,000 (round number + option-strike liquidity; also cited by multiple local technical writeups).

- Support 2 (deeper): 24,600 – 24,900 (50%–61.8% Fib cluster ~ 25,083 and 25,024 respectively; break below 24,900 likely opens 24,400–24,000). (computed).

- Bear trap zone: 24,800–25,000 — if index falls here with declining volume, look for possible short-covering rallies.

(Fibonacci retracements from the recent swing: 38.2% ≈ 25,141, 50% ≈ 25,083, 61.8% ≈ 25,025). (computed).

4) How the 100% U.S. tariff news changes the technical outlook

- Immediate effect (within 1–3 trading sessions): risk-off → higher intraday volatility, larger gaps at open, and higher probability of a breakdown through short-term supports (SMA-5 / 25,140 and then 25,000). Global risk-off historically prompts FPI outflows from EM including India — that intensifies downward pressure on indices.

- If the tariff story persists (1–4 weeks): technical structure shifts from a short sideways/flat regime to bearish — expect Nifty to test the 24,600–24,000 band (severe shock scenario) as risk premium rises and liquidity is repriced.

- If tariff is seen as short-lived / watered down: markets tend to retrace losses quickly; the 25,140–25,330 band becomes key to recapture to resume bullish bias.

5) Probabilistic scenarios (tactics & targets tied to market paths)

All levels assume continued high global uncertainty; timeframes in parentheses.

- Base / “Pullback” scenario (most likely short-term; 45% probability)

- Trigger: short squeeze fails; risk-off but no systemic shock.

- Price path: fall to 25,000 → bounce to 25,200–25,400.

- Trading play: buy on dips only if volume on dip declines and reversal candle + close above 25,140. Stop 50–75 pts below entry.

- Bear / “Protracted trade war” scenario (medium stress; 35% probability)

- Trigger: U.S. implements tariffs and China retaliates / supply constraints stay.

- Price path: break 25,000, test 24,600 → 24,000 over 1–4 weeks.

- Trading play: reduce cyclicals, hedge long exposure (index puts or short Nifty futures). If shorting, initial targets 24,600 and 24,000, stop above 25,300.

- Crash / “Extreme shock” scenario (low prob but high impact; 20%)

- Trigger: trade shock leads to global risk cascade, FPI heavy outflows, rupee collapse.

- Price path: swift drop > 12% — Nifty into 22,000–20,000 zone.

- Trading play: move to cash/defensives; buy selective high-quality names only after volatility subsides and local liquidity is restored.

6) Sector & stock implications (technical tilt)

- Likely weaker / underperformers (technical risk): IT & export-oriented names if global demand drops; Autos & Consumer electronics using Chinese components (supply cost shock). Watch relative weakness vs index (lower highs on RSI, negative divergence).

- Potential outperformers: Select exporters who can win orders displaced from China (textiles/garments), domestic defensives (FMCG, utilities), and selected PSU banks/commodity names if safe-haven flows stabilize; watch relative strength lines (RSR) and rising volumes on up days.

7) Tactical checklist (what to watch in the next 48–72 hours)

- Price action vs 25,140 (SMA-5 / 38% Fib) — decisive close above = short squeeze / above-bias; decisive close below = open to 25,000 then 24,600. (computed + local technicals).

- FPIs net flows (daily) — sustained net outflows increase downside probability. (macro/news).

- USD/INR movement — sharp rupee depreciation worsens local liabilities and risk premia; look for 1%+ moves intraday. NSE India

- Volume pattern — falling volume into supports suggests weak conviction (possible bounce); rising volume on breaks confirms sellers. (price/volume confirmation rule).

- Global cues — S&P 500 / Nasdaq follow-through after the U.S. announcement will likely lead Nifty opens/gaps. Reuters

8) Risk management & hedging (practical)

- Protective puts: buy short-dated index puts to limit portfolio drawdown (strike near 24,800–25,000 depending on risk appetite).

- Futures hedge: short a portion (20–40%) of notional exposure in Nifty futures as tactical hedge while keeping core equities.

- Options collar: finance puts by selling covered calls if you still want upside exposure but limit cost.

- Position sizing: in elevated volatility, reduce new position sizes by 25–50% and widen stops to avoid whipsaws.

9) Bottom line (concise)

- Near term: technicals are fragile — price sits near SMA-5 / 38% Fib (~25,140). Tariff news raises the chance of a drop toward 25,000; break below opens 24,600–24,000.

- Tactical: wait for price + volume confirmation before adding risk. Hedge or reduce exposure if Nifty closes below 25,000 with rising volume and global risk-off persists.

- Longer term: if tariffs are temporary or partial, rebounds are likely; if persistent, technicals shift to bearish and lower targets come quickly.

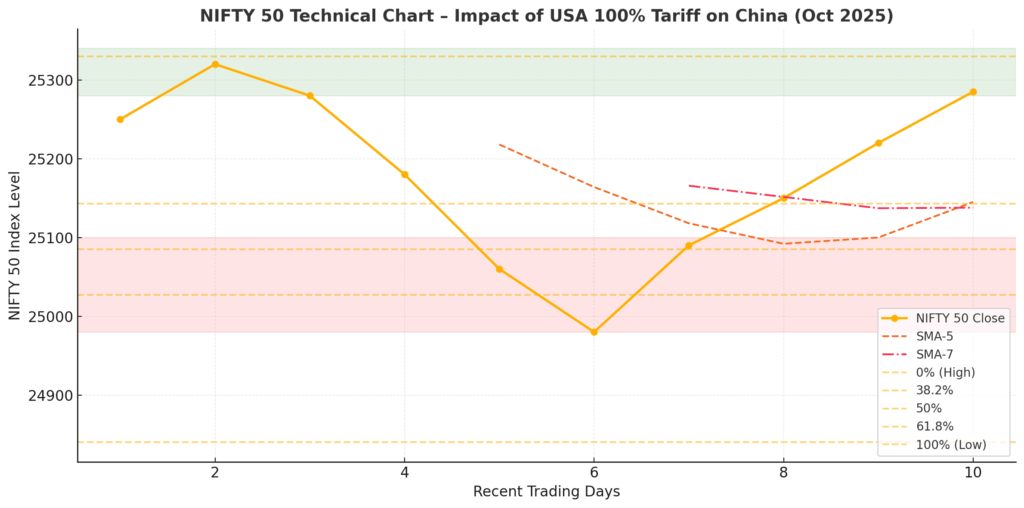

NIFTY 50 Technical Chart – Impact of USA 100% Tariff on China (Oct 2025)

Here’s the NIFTY 50 technical chart reflecting the potential impact of the U.S. 100% tariff on China:

- 🟥 Support Zone (₹24,980 – ₹25,100) → Key short-term floor; breakdown could invite deeper correction toward ₹24,600.

- 🟩 Resistance Zone (₹25,280 – ₹25,340) → Reclaiming this band would signal resilience or a short-covering rally.

- SMA-5 & SMA-7 (dashed lines) show narrowing momentum — volatility could expand either way.

- Fibonacci levels highlight retracement bands at 38.2%, 50%, and 61.8%, aligning with major price pivots.

Overall, the chart indicates fragile bullish structure under pressure, with the tariff shock likely to trigger a move toward the lower Fib retracement levels unless global sentiment stabilizes.