Let’s break it down cleanly:

“If tariffs are inflationary, why is copper (an inflation hedge and industrial metal) down?”

🧭 1. First principle — copper = “Dr. Copper”, a growth barometer

Copper isn’t mainly a monetary metal like gold; it’s an industrial demand proxy.

About 70% of copper demand comes from construction, power grids, electronics, EVs, etc.

So, it tracks global manufacturing health, especially China and U.S. industrial activity.

When tariffs rise, markets instantly think:

- 🏭 Slower global trade → fewer exports, less manufacturing

- 📦 Disrupted supply chains

- ⚙️ Delayed capex & factory spending

- 📉 Lower future copper demand

So even though tariffs may cause headline inflation, they hurt real economic demand — and copper prices fall because demand destruction > inflation benefit.

🧩 2. The mechanics of the 100% U.S. tariff on China

- The new U.S. tariffs mainly hit Chinese industrial exports — including EVs, batteries, electronics, and tech components.

- Those are copper-intensive sectors (especially EVs, renewable energy wiring, and manufacturing).

- A tariff shock means:

- U.S. importers reduce Chinese orders → factory activity in China slows.

- Global supply chains readjust (short-term chaos).

- Commodity traders cut long exposure in “growth metals” like copper.

That’s why copper sells off first, even if inflation later creeps up.

💰 3. Market psychology & positioning

In the first 48–72 hours after such a headline:

- Investors flee risk: sell cyclicals, buy safe havens (gold, USD, Treasuries).

- Funds unwind “reflation trades” (long copper, long oil, short USD).

- Copper gets caught in the risk-off unwinding.

Even if CPI later rises, that’s a slower process; copper trades immediately on growth signals.

📉 4. Copper-specific fundamentals amplify the move

- Chinese growth already fragile:

- 2025 data show slower property construction, weaker PMI (~49–50 zone).

- Tariffs add uncertainty → further weigh on copper-intensive sectors.

- Inventories:

- LME and SHFE inventories rose in recent weeks (sign of demand slack).

- USD strength:

- Trade tensions strengthen the dollar (safe-haven demand).

- Since copper is dollar-priced, strong USD = extra pressure.

- Speculative positioning:

- Funds were long copper anticipating Chinese stimulus.

- Tariff shock = stop-outs / profit-taking.

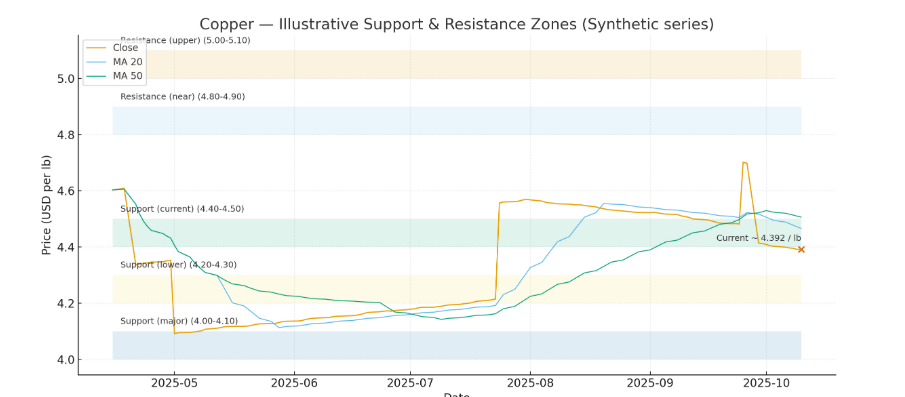

⚙️ 5. Technical picture (Oct 2025 context)

Current Price Context

- Copper is trading around US $ 4.48 per pound on Kitco.

- On the futures side (Copper Dec 2025 contract, “HG=F”), price is ~ $4.6440 as per Yahoo Finance.

- The 52-week range for copper futures is ~ $4.00 – $5.9585

Support & Resistance Zones to Watch

Below are likely support and resistance zones (in USD per pound for futures / spot) based on recent price action, pivot levels, and technical studies:

| Level Type | Zone / Price | Notes / Why It Matters |

|---|---|---|

| Resistance | ~$5.00 – $5.10 | This is near the upper bound of recent trading for futures, and bounces off this area could pressure downside. |

| Resistance | ~$4.80 – $4.90 | A nearer resistance — price is currently below this zone (4.6440) so this zone may act as a barrier on the upside. |

| Support | ~$4.40 – $4.50 | Around current levels, this zone may provide a cushion (price is already ~4.48). |

| Support | ~$4.20 – $4.30 | If price drops more, this lower band may become a more “strong” support. |

| Support | ~$4.00 – $4.10 | As a major base (bottom of 52-week range), this is a “last line” support zone before major weakness. |

Fibonacci / Retracement Perspective

If we take a recent swing high to swing low, we can draw Fibonacci retracement levels to refine the zones:

- 38.2% retracement might lie around ~$4.70–$4.80

- 50% retracement around ~$4.80–$4.90

- 61.8% retracement closer to ~$5.00

These often overlap with the resistance zones above, giving more weight to those levels.

Suggested Trading Implications & Caution

- A clean break above $4.80–$4.90 with volume could open a run toward $5.00+

- Failure to hold the $4.40–$4.50 zone could lead to retest of $4.20–$4.30

- Because the tariff news introduces big macro uncertainty, price may “overshoot” these zones — use stops or confirm breakouts

- Monitor volume, price action, and confirmation (candlestick patterns, momentum, RSI) when price approaches these zones

🔄 6. Possible future path

| Scenario | Copper Outlook | Rationale |

|---|---|---|

| Tariff escalation continues | 🔻 Bearish | Slower global manufacturing, strong USD |

| Fed cuts rates to offset slowdown | ⚖️ Neutral to mildly bullish | Lower USD may support prices |

| China launches new stimulus | 🔺 Bullish recovery | Infrastructure & grid spending boost demand |

| Trade truce / rollback | 🔺 Bullish | Rebuilds optimism, copper could rebound toward $4.4–$4.6/lb |

🧭 7. In one line:

Gold goes up on fear & inflation → Copper goes down on fear & growth slowdown.

Tariffs cause both — but copper feels the growth pain first.