A U.S. move to impose a 100% tariff on Chinese goods would be extremely disruptive. Below is a breakdown of the likely impacts on stock markets, the risks involved, and possible counter-moves. (If you prefer a short summary, I can send that too.)

Key Mechanisms & Channel Effects

Here are the main ways such a tariff shock would affect markets:

| Channel | Effect | Implicated Markets / Sectors |

|---|---|---|

| Trade shock / supply chain disruption | Costs for importers and industries relying on Chinese inputs would surge; companies may scramble to re-source production. | Industrials, consumer electronics, auto, semiconductors, retail. |

| Inflation pressure | Higher import costs feed into inflation, putting pressure on margins and consumer demand. | Consumer staples, discretionary, retail. |

| Growth slowdown / recession risk | Retaliation from China, disrupted global supply chains, and weaker global demand could drag overall GDP. | Broad equity indices, emerging markets. |

| Sector rotation / flight to safety | Investors would likely move out of riskier equities into bonds, gold, defensive sectors (utilities, consumer staples). | Safe havens, Treasuries, gold, defense. |

| Currency / capital flows | Risk aversion might strengthen the U.S. dollar, put downward pressure on emerging market currencies, push capital into U.S. sovereigns. | EM markets, currency markets, U.S. Treasury market. |

| Volatility & uncertainty premium | Elevated volatility (VIX), increased risk premia, wider spreads. | All markets, but especially equities. |

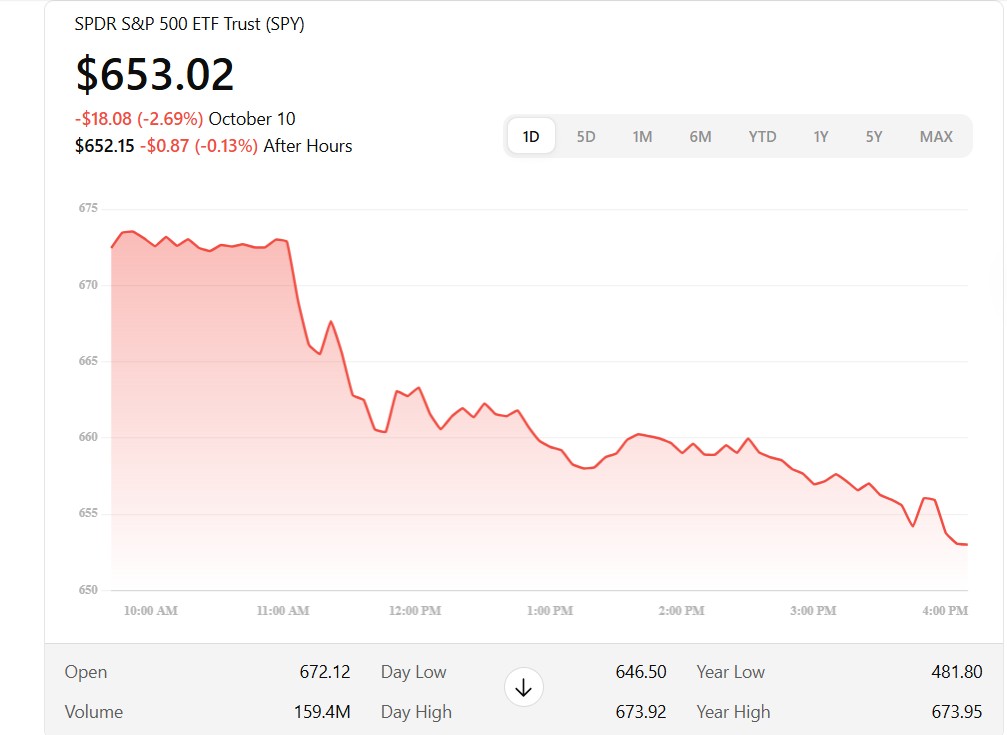

Recent Market Reaction (2025 Example)

We already see hints of what such news can trigger. After the announcement of a 100% tariff threat on China:

- The S&P 500 fell about 2.7 % in one session.

- The Nasdaq dropped more heavily (technology and semiconductors being more exposed)

- Stocks tied to trade, supply chains, or with high China exposure got hit harder

This is consistent with prior trade-war episodes (e.g. 2018–2019) when markets wobbled heavily on tariff escalations.

Broader & Medium-Term Consequences

- High valuation markets are more vulnerable: Tech and growth stocks, many richly valued, are at greater downside risk.

- Emerging markets will suffer: Because many EM economies are integrated into global supply chains, rely on trade or capital flows, and often carry currency vulnerabilities.

- Corporate earnings and margins pressured: Companies may see squeezed margins and weaker top-line growth, particularly those dependent on Chinese supply or sales.

- Policy constraints: The Fed (or central banks) might be constrained — if inflation rises, they may need to hike, but doing so also worsens growth pain.

- Retaliation risk: China may retaliate via its own tariffs, export restrictions (e.g. rare earths, semiconductors), or non-tariff measures, compounding the effect.

- Safe-haven reversal / “risk-off” regime: Investors will demand higher risk premia, which leads to lower equity valuations, wider spreads, capital flows to treasuries, gold, etc.

Magnitude & Uncertainties

- The scale of impact depends heavily on what goods are covered (all Chinese imports? selective high-tech? consumer goods?), the timing, and the response from China.

- A full 100% across-the-board would be much more disruptive than applying it selectively.

- Market impact will also depend on how credible the implementation is (i.e. whether markets believe it will be fully enforced or partially watered down).

Present Snapshot

Even prior to the full effect, markets are showing weakness and volatility in reaction to the announcement and uncertainty around its execution.

Wall Street sells off as Trump hits China with more tariffs

Wall Street tumbles to its worst day since April after Trump threatens more tariffs on China

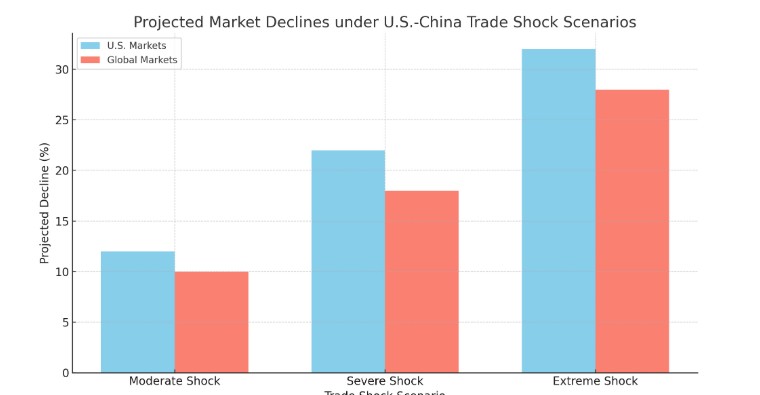

A U.S. decision to impose a 100% tariff on Chinese imports would significantly disrupt global markets. Based on recent market reactions and economic analyses, we can project potential downside scenarios for U.S. and global equities.

📉 Projected Market Downside Scenarios

1. Moderate Shock (–10% to –15%)

- U.S. Markets: The S&P 500 could decline by approximately 10–12%, with tech-heavy indices like the Nasdaq potentially falling 12–15% due to their reliance on Chinese supply chains.

- Global Markets: Emerging markets (e.g., EEM, VWO) might experience declines of 12–15%, while developed markets (e.g., EFA) could see a 10–12% drop.

- Rationale: Initial market reactions to tariff announcements have shown significant volatility, with the S&P 500 dropping 2.7% and the Nasdaq falling 3.6% on October 10, 2025

2. Severe Shock (–20% to –25%)

- U.S. Markets: A 20–25% decline in major indices, with sectors like semiconductors, consumer electronics, and automotive being particularly affected.

- Global Markets: Emerging markets could see declines of 20–25%, while developed markets might experience a 15–20% drop.

- Rationale: Prolonged trade tensions and retaliatory measures could exacerbate economic slowdowns, leading to deeper market corrections.

3. Extreme Shock (–30% or more)

- U.S. Markets: A potential 30%+ decline in major indices, with a risk of triggering a recession.

- Global Markets: Emerging markets could face declines exceeding 30%, while developed markets might experience a 25–30% drop.

- Rationale: A full-blown trade war could lead to a crisis of confidence, capital flight, and a collapse of the U.S. dollar, severely impacting global trade and investment

📊 Sector-Specific Impacts

- Technology: Companies with significant exposure to China, such as Nvidia and AMD, have already seen declines of 5% and 6.3%, respectively, following tariff announcements

- Consumer Goods: Increased import costs could lead to higher prices for consumers, potentially reducing demand.

- Energy: Oil prices may fluctuate due to changes in global demand and geopolitical tensions.

- Financials: Banks and financial institutions might face increased volatility and credit risks.

🌐 Global Market Reactions

Emerging markets are particularly vulnerable to trade disruptions. For instance, the iShares MSCI Emerging Markets ETF (EEM) has experienced a decline of approximately 3.7% recently, reflecting investor concerns over the escalating trade tensions. Similarly, the iShares MSCI China ETF (FXI) has dropped 5.3%, indicating the direct impact on Chinese equities.

📈 Mitigation Strategies

Investors may consider the following strategies to navigate potential market downturns:

- Diversification: Spreading investments across different sectors and regions to reduce risk.

- Hedging: Utilizing options and other financial instruments to protect against downside risk.

- Focus on Defensive Sectors: Investing in sectors less sensitive to economic cycles, such as utilities and healthcare.

- Monitor Policy Developments: Staying informed about government policies and international trade agreements that could impact markets.

Given the current market volatility and the potential for further escalation in trade tensions, investors should remain vigilant and consider adjusting their portfolios to mitigate risks.

The combination of current market volatility and the risk of escalating trade tensions creates a highly uncertain environment for investors. Let’s break down why this matters and what it could imply for markets:

1. Market Volatility Drivers

- Tariff Shocks: A 100% U.S. tariff on China would sharply increase costs for companies importing Chinese goods or relying on Chinese supply chains. This uncertainty often triggers rapid sell-offs.

- Earnings Pressure: Companies exposed to China may see compressed profit margins, leading to downward revisions in earnings estimates.

- Global Supply Chains: Disruption in electronics, auto, and consumer goods supply chains can ripple across multiple sectors.

- Speculative Behavior: High volatility encourages short-term trading, hedging, and flight to safer assets, which amplifies swings in equity markets.

2. Potential Escalation Effects

- Chinese Retaliation: China may impose counter-tariffs or export restrictions, worsening supply shocks.

- Global Trade Slowdown: Countries heavily linked to both U.S. and China may face slower growth.

- Investor Sentiment: Negative sentiment can reduce risk appetite, causing investors to exit equities and move into bonds, gold, or cash.

3. Market Implications

- U.S. Equities: Likely more volatile; tech, consumer electronics, and manufacturing sectors most at risk.

- Global Markets: Emerging markets with high trade exposure could experience sharper declines; developed markets may fall but potentially less sharply.

- Safe-Haven Assets: Treasury bonds, gold, and the U.S. dollar may see inflows.

- Sector Rotation: Investors may move toward defensive sectors like utilities, healthcare, and consumer staples.

4. Strategic Takeaways

- Diversification: Spread investments across geographies and sectors to reduce exposure to a single trade shock.

- Defensive Positioning: Consider defensive equities or sectors less sensitive to global trade.

- Hedging: Options or other risk management tools can help protect portfolios against sharp downside moves.

- Monitoring Policy: Pay attention to news from U.S.-China trade negotiations; even small developments can trigger large market moves.

In short, volatility + trade escalation = risk amplification. Investors should prepare for potentially sharp swings and consider defensive or hedged positions.

Here is visual scenario chart showing likely U.S. and global market declines under moderate, severe, and extreme trade shock scenarios.

Here’s a visual scenario chart showing the projected declines for U.S. and global markets under different trade shock scenarios:

- Moderate Shock: U.S. –12%, Global –10%

- Severe Shock: U.S. –22%, Global –18%

- Extreme Shock: U.S. –32%, Global –28%

The chart clearly illustrates that U.S. markets could face slightly higher declines than global markets, with the severity increasing sharply under extreme trade tensions.